In the current context of the COVID-19 pandemic, public health and access to it has (re)emerged as a major issue. In Vietnam, as anywhere else around the world, the pandemic has increased local demand for quality pharmaceuticals and hospital services.

Since 1st, August, 2020, the EVFTA has reduced tariffs on pharmaceuticals and medical devices. These gradual reductions will therefore help to increase trade from the EU to Vietnam. This reduction will also “ensure easier access to innovative, high-quality medicines for the Vietnamese population”, and thus meet domestic demand.

Today, Vietnam’s domestic production is limited to basic pharmaceutical products. Conversely, the European Union produces state-of-the-art pharmaceuticals and medical devices, meeting high quality and safety standards. Thus, the EVFTA can be seen as a tool for the complementarity of these two economies.

Overview of Vietnam’s pharmaceutical industry

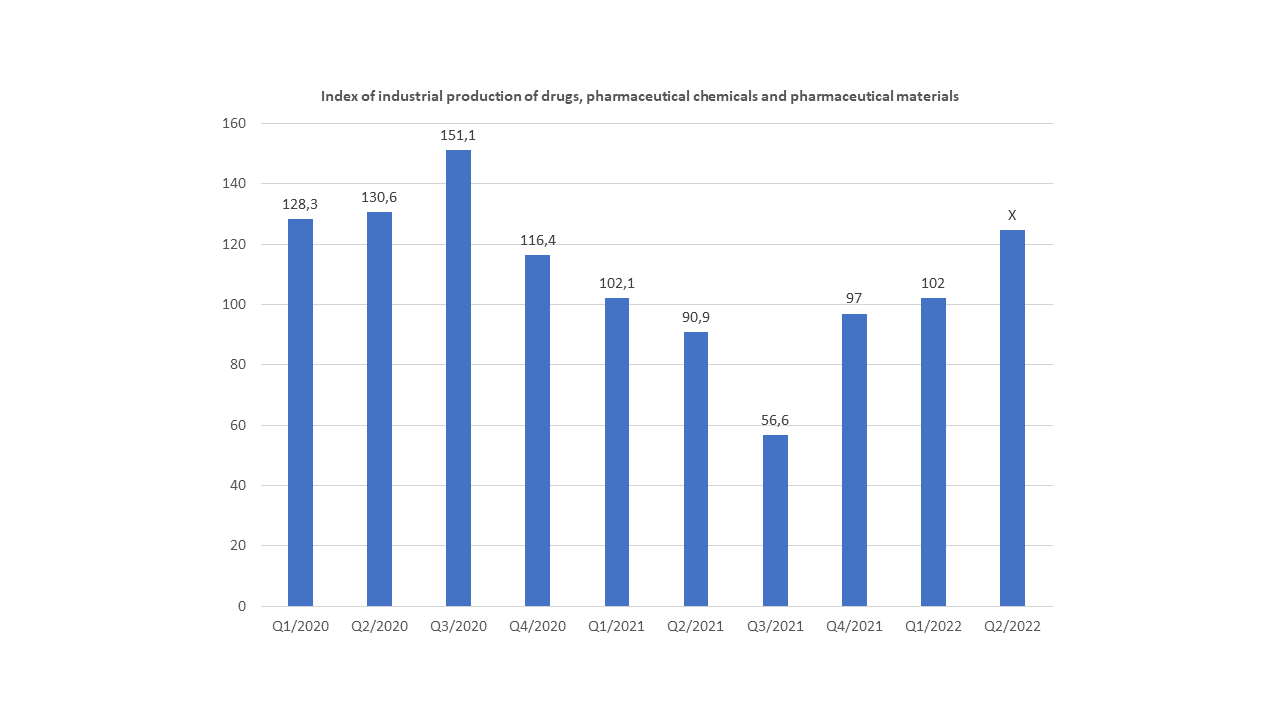

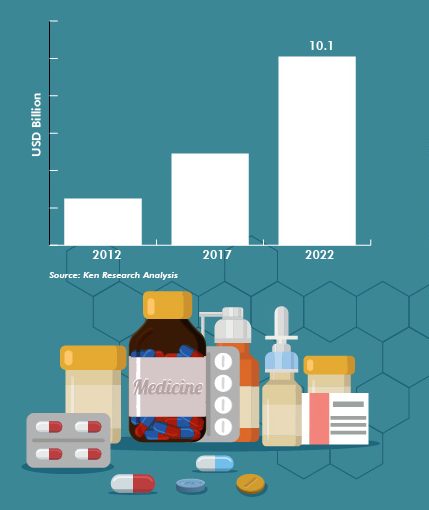

“Vietnam is expected to continue to be among the 20 countries with the strongest and most stable pharmaceutical growth in the world”. This is the conclusion of numerous studies conducted by major research companies such as BMI and Euromonitor International.

Indeed, for several years, the Vietnamese pharmaceutical market has been experiencing strong growth with an annual rate of 10.6% between 2015 and 2017.

Nevertheless, these Vietnamese companies focus mainly on generic drugs. For the rest (e.g. medical devices, biotech, etc.), 86% of the supply is ensured by imports, especially from the Union (13.5%).

While the potential of the health sector is a certainty, Vietnam’s ability to invest and innovate in this field is less so. At this level, the young Asian dragon needs the knowledge and skills of its European partners. But the cooperation between the EU and Vietnam is already existing in this sector. For example, between 2012 and 2017, the EU has granted 1 billion euros to the health sector in Vietnam “to help it improve its skills, particularly in the delivery of preventive health care“.

Now, under the EVFTA, the development of this cooperation is facilitated and would reinforce Vietnam’s attractiveness in this sector.

Easier access to the Vietnamese market for European companies

A gradual reduction in customs duties

The aging of medical equipment in public hospitals has led Vietnam to apply, under the EVFTA, low tariffs and not to impose quotas for these products. Similarly, for pharmaceutical products.

Concerning pharmaceutical products, customs duties ranged from 0 to 14%. Now, since the entry into force of the EVFTA, 51% of these pharmaceuticals are already benefiting from an immediate exemption. The other products will be zero-rated within 7 years.

This important evolution will have a concrete effect on EU’s exportations to Vietnam in the pharmaceutical sector.

For example, in 2019, French exports of pharmaceutical products to Vietnam amounted to 263 million euros, an increase of 24.6% compared to 2018. The Pharmaceutical industry is a key sector that represents 16.27% of total French exports to Vietnam.

With these figures and, thanks to its expertise in terms of medicines and equipment, France is now the leading supplier of medicines to Vietnam. Thus, the reduction of customs duties will enable France to maintain its position and increase its share in this sector.

Access to Vietnamese government procurement markets

At the end of a 2-year transitional period following the ratification of the EVFTA, European companies will be able to access the Vietnamese public procurement markets.

This access is conditioned on the respect of thresholds, whose values will be progressively lowered within 15 years. This will reduce the share of public contracts reserved for local companies to 50%.

Thanks to this opening, the Ministry of Health and the 34 public hospitals will be able to centralize their purchases of pharmaceutical products. Moreover, this opening will save time and money for these entities and it will open up a new window of opportunity for European companies.

Possibility to establish a “foreign investment company”

Vietnamese law prohibits foreign companies from directly distributing medicines on its territory. European companies are forced to use domestic companies to access the Vietnamese market, notably through mergers and acquisitions.

However, under the EVFTA, Vietnam has undertaken to allow foreign companies, particularly European ones, to establish a pharmaceutical company in its territory. Thus, these companies will be able to legally import their pharmaceutical products, store them in their own warehouses and then resell them to local distributors and wholesalers.

Protection of European medical know-how

Pharmaceutical data protection

Vietnam has committed to protect for a period of 5 years, the data of pharmaceutical products resulting from tests.

However, when the disclosure of data results from a prerequisite for obtaining marketing authorization for pharmaceutical products, Vietnam commits to protect such data against unfair commercial exploitation.

Protection of intellectual property rights

The marketing of pharmaceutical products protected by a patent is subject to an administrative authorization procedure which can, at times, be lengthy.

Under the EVFTA, the term of the patent and associated rights will be extended when undue delays due to the administrative procedure shorten the effective period of the patent. The maximum duration of this extension will not exceed two years. In this way, administrative contingencies will be compensated making Vietnam a safer market for European pharmaceutical companies.

Thus, at a time when the demand for healthcare is increasing rapidly in the region, the EVFTA makes the Vietnamese pharmaceutical industry more attractive. This attractiveness will enable the development of European investment and it will allow for the Vietnamese population to benefit from European pharmaceutical products of good quality and at low prices.

The exemplary management of the COVID-19 pandemic by the Vietnamese government and the challenges caused by the ageing population and access to healthcare in isolated areas, make Vietnam a land of opportunities for the development of this industry.

However, there is still a risk of dependence on the Union. Will facilitating the export of European innovation and know-how to Vietnam at lower cost enable the Vietnamese pharmaceutical industry to develop its own competence or, on the contrary, will it leave this industry in the shadow of European competence?

By: https://www.ccifv.org/en/vietnam/benefit-from-evfta/sectors/pharmaceutical.html, dated 07Feb2023

Comments